Invest Success Blog

Helping You Learn to Master Real Estate Investing in Colorado!

Patience & Perception in Real Estate Investing

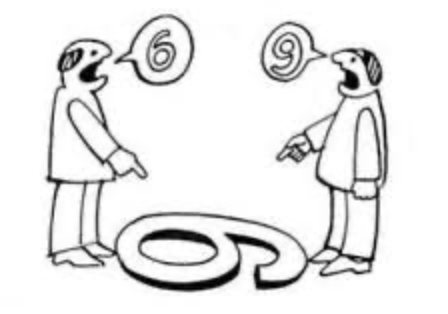

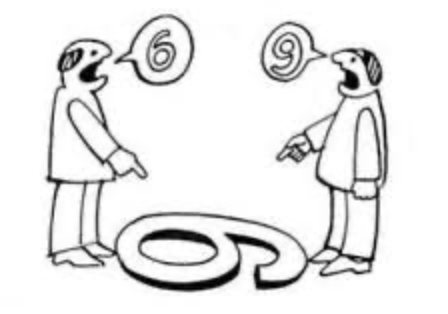

“Success in real estate investing often hinges on two key principles: patience and perception. Patience to wait for the right opportunity, and perception to see potential where others might overlook it.”

Acting on the principle of patience and perception in real estate investing involves several key steps:

Research and Education: Take the time to educate yourself about the real estate market, local trends, and investment strategies. This foundation will help you develop the patience to wait for the right opportunity.

Define Your Investment Criteria: Clearly outline your investment goals, risk tolerance, and criteria for potential properties. Knowing what you're looking for will help you patiently wait for opportunities that align with your objectives.

Market Monitoring: Stay informed about the real estate market in your target area. This involves tracking property prices, rental rates, demographic shifts, and economic indicators. Patience comes from understanding market cycles and waiting for favorable conditions.

Networking: Build relationships with real estate professionals, investors, and other industry experts. Networking can provide valuable insights and opportunities that others might overlook, enhancing your perception of potential investments.

Due Diligence: Conduct thorough due diligence on potential properties. This includes financial analysis, property inspections, and evaluating market dynamics. Perception comes into play when you can identify hidden value or potential in a property that others may not recognize.

Risk Management: Mitigate risks by diversifying your real estate portfolio, maintaining adequate reserves, and having contingency plans in place. Patience is crucial in avoiding impulsive decisions that could expose you to unnecessary risks.

Adaptability: Be flexible and open-minded in your approach to real estate investing. Market conditions and opportunities can change, so be prepared to adjust your strategies accordingly while maintaining your long-term vision.

By integrating patience and perception into your real estate investing approach, you can increase your chances of success and build a sustainable portfolio over time. Invest Success can help you gain the education and networking to help you be a smarter investor and take action. Join us for a free class @ Invest-Success.com/First-Class-Free

Patience & Perception in Real Estate Investing

“Success in real estate investing often hinges on two key principles: patience and perception. Patience to wait for the right opportunity, and perception to see potential where others might overlook it.”

Acting on the principle of patience and perception in real estate investing involves several key steps:

Research and Education: Take the time to educate yourself about the real estate market, local trends, and investment strategies. This foundation will help you develop the patience to wait for the right opportunity.

Define Your Investment Criteria: Clearly outline your investment goals, risk tolerance, and criteria for potential properties. Knowing what you're looking for will help you patiently wait for opportunities that align with your objectives.

Market Monitoring: Stay informed about the real estate market in your target area. This involves tracking property prices, rental rates, demographic shifts, and economic indicators. Patience comes from understanding market cycles and waiting for favorable conditions.

Networking: Build relationships with real estate professionals, investors, and other industry experts. Networking can provide valuable insights and opportunities that others might overlook, enhancing your perception of potential investments.

Due Diligence: Conduct thorough due diligence on potential properties. This includes financial analysis, property inspections, and evaluating market dynamics. Perception comes into play when you can identify hidden value or potential in a property that others may not recognize.

Risk Management: Mitigate risks by diversifying your real estate portfolio, maintaining adequate reserves, and having contingency plans in place. Patience is crucial in avoiding impulsive decisions that could expose you to unnecessary risks.

Adaptability: Be flexible and open-minded in your approach to real estate investing. Market conditions and opportunities can change, so be prepared to adjust your strategies accordingly while maintaining your long-term vision.

By integrating patience and perception into your real estate investing approach, you can increase your chances of success and build a sustainable portfolio over time. Invest Success can help you gain the education and networking to help you be a smarter investor and take action. Join us for a free class @ Invest-Success.com/First-Class-Free

Still have questions?

Invest Success is a 12-month, in-person, mentorship program to help you find, fund, fix, and flip your first investment property.

© Copyright 2024. Invest Success. All rights reserved.